The professionals at Oregon's Best Mortgage (Demark Financial Services, Inc) have been making mortgage loans to Oregonians for the past three decades. We specialize is securing for our clients:

LOWEST RATES AND FEES!

GREAT LOAN OPTIONS!

- Conventional loans with only 3% down up to $453,100

- Elite low interest rate loans with good credit scores

- FHA loans with 3.5% down payment

- VA loans with 0% down payment

- USDA loans with 0% downpayment in rural areas

- First time homebuyer options

- Manufactured housing

- High balance loans up to $679,650 with lower than Jumbo rates

- Jumbo loans up to $3,000,000

- 12 month bank statement loans with no tax returns required

- Investment property purchase loans with only 15% down

- Renovation and rehab loans

- and so many more options

EXCELLENT SERVICE!

Since 1983, we have been able to offer our clients the best mortgage products with the lowest interest rates and fees in the Oregon mortgage industry. We work hard to understand each borrower's particular situation and develop custom mortgage products geared to your individual needs. We strive to meet those specific needs with a wide array of products, investment tools, mortgages and best of all quality service and individual attention.

Today's technology is providing a more productive environment to work in. For example, through our website you can submit a complete on-line, secure loan application or pre-qualify for a home loan. You may also evaluate your different financing options by using our interactive calculators and going over various mortgage scenarios. Or just give us a call, and we will handle the paperwork for you. We are available to meet with you personally, and spend the time needed to help you understand your options and make the mortgage process an enjoyable experience.

Oregon's Best Mortgage is locally owned and operated and committed to Oregonians.

Recent Articles

28

2026

When most homeowners hear the word refinance, they immediately think one thing: getting a lower interest rate. While that can certainly be part of the picture, it’s far from the whole story. In reality, refinancing is less about chasing rates and more about using your mortgage as a...

19

2026

If you’ve been waiting for the right moment to buy a home, this could be the sign you’ve been looking for. Mortgage rates have recently dropped to their lowest level in nearly three years, creating a rare window of opportunity for homebuyers. After a long stretch of higher...

12

2026

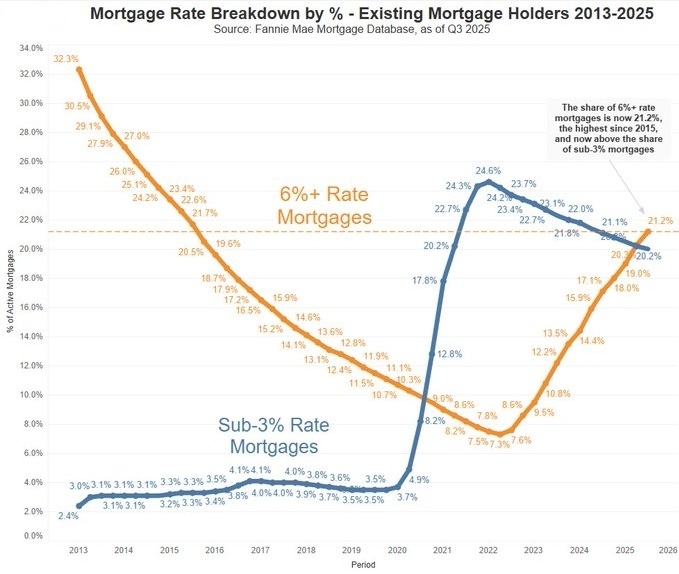

For the past few years, one phrase has dominated housing market conversations: the mortgage rate lock-in effect. Millions of homeowners secured ultra-low mortgage rates below 3% during the pandemic, creating a powerful disincentive to sell. Why give up a once-in-a-lifetime rate and...

30

2025

If the mortgage market felt unusually quiet over the holiday stretch, that’s because it was. The final weeks of December are known for “holiday trading,” which is when fewer people are actively buying and selling in the bond market. Since mortgage rates are driven by...

DeMark Financial Services Inc.

8720 SW Curry Rd Unit B

WILSONVILLE, OR 97070

Phone: (503) 407-2255

demarkfs@comcast.net